If you saw the 2017 movie The Current War, about the AC/DC current war between Nikola Tesla and Thomas Edison, you may have wondered, who is this Samuel Insull? (Other than the fact that he is the character played by actor Tom Holland.) Tesla and Edison may be household names, but the energy industry as we know it wouldn’t look like it does now with the energy business innovations of Samuel Insull. It is a common clichè that artists don’t always make for the best business people/salesmen. As is true for intellectual and creative people, such as artists, writers, and philosophers, scientists that find large success usually must also have a knack for business and sales. Samuel Insull contributed to the electrical infrastructure of the United States with his mind for innovations in both the technology and the business of electrical energy.

Insull was raised in London, and at 19 he became the private secretary and bookkeeper to Colonel George Gouraud, the London representative of Thomas Edison’s telephone companies. He used this job to propel him into a career in the industry, and later took a job as Thomas Edison’s personal secretary in the United States. Insull took on increasing responsibilities in Edison’s business endeavors and collaborated with Edison in building electrical power stations throughout the US. In 1889, Insull became vice president of the Edison General Electric Company. Later, upset that he wasn’t named president of Edison General Electric, Insull took a job as president of the Chicago Edison Company. Because of his work in Chicago, Insull is remembered for his many managerial and technological innovations that transformed the utility system into its modern structure. His leadership introduced practices still used today, such as time of use rates, regulated monopolies, and holding companies.

Insull’s Business Innovations: Time of Use Rates, Regulated Monopolies, and Holding Companies

Time of Use Rates. One of Insull’s most notable improvements at the Chicago Edison Company was introducing a new pricing model called Time of Use Rates. When Samuel Insull arrived in Chicago in 1892, the town hosted more than twenty companies producing electricity. Rather than a flat fee for electricity, Chicago Edison charged more during peak usage hours and less when demand was low. Insull increased his load factor by enticing customers such as street railway companies, ice houses, and other businesses with low rates for off-peak power usage. Lower-cost power stimulated demand, while still earning healthy profits for his company. By seeking those who would use electricity outside of the most popular evening hours, he could build a larger user base, and price the utility low enough for small businesses and households to afford it. This meant the company could build fewer power plants and run existing plants closer to capacity. This simple business model innovation was foundational for Chicago Edison’s amazing growth and gave almost every household and business in the area access to electricity. Time of use rate remains the primary pricing model for large electric customers to this day.

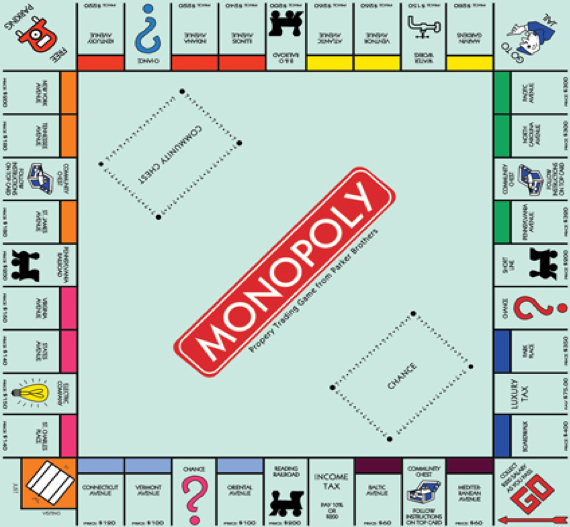

Regulated Monopolies. Insull’s next company, Commonwealth Edison, kept pace with the technological innovations of the electrical industry. His company’s ability to remain adaptable helped it to evolve and experience rapid growth. Commonwealth Edison used alternating current (AC) grids, which distributed electrical energy for miles and increased the number of customers who could be served by a single power plant. Commonwealth Edison then became one of the early adopters of steam turbines, which eventually dwarfed traditional power plants and could produce electricity at higher volumes and for less money. With his financial momentum, his AC power grid, and his mammoth steam turbines, Insull offered the lowest-cost electricity, and gained customers across Illinois. He bought and shut down the power plants of his competitors and repurposed the plants as substations connected to his AC grids and steam turbines which is a practice known as consolidation. Insull’s strategies became emulated by utility entrepreneurs in other cities throughout the United States. Insull had, effectively, built a monopoly.

People grew angry at wide-reaching control of natural monopolies like the railroad and electric companies. Cities, towns, and other municipalities responded by taking over the private electric companies and becoming their own utilities. They believed their lack of profit motives allowed them to serve customers’ needs better than shareholder-owned companies.

Insull saw that this trend would ultimately lead to a government-run power industry, and so to avoid losing his dominant position in the marketplace, Insull began to promote the idea of the government-regulated monopoly. His argument was that municipalities lacked the technical expertise and business know-how to effectively run complex utility systems like electrical infrastructure. Over the last century, the regulated monopoly has become the primary business model for electricity across America and virtually every other country in the world.

Holding Companies. In order to keep expanding, Insull needed more capital, so he embraced a growing idea called holding companies. A holding company is a parent company that directly or indirectly owns a majority or all the voting securities (such as common stock) of one or more electric utility companies located in the region. These organizations allowed a set of related businesses to be financially managed under a single legal umbrella. Costs could be consolidated via shared services, and more capital could be raised at a lower cost. With only $27 million in equity, Insull built an empire worth more than $300 million. Soon, Insull’s holding company strategies were being widely copied.

After the economic downturn, precipitated by the stock market crash of 1929 and the fallout of the Great Depression, many holding companies, including all of Insull’s, collapsed, and the collapse of his many holding companies caused the 600,000 of his shareholders’ life savings to be completely wiped out. For many in the general public, Insull epitomized the greed and excesses that led to the Great Depression; a narrative strikingly similar to today’s world. Insull soon faced mail fraud and antitrust charges. He fled to Europe, only to be extradited. Although Insull was found not guilty on all charges, the trial tarnished his reputation. All of this led to the enactment of the Public Utility Holding Company Act of 1935, a US federal law that gave the Securities and Exchange Commission authority to regulate, license, and break up electric utility holding companies.

Samuel Insull’s risks in business and commitment to new technology helped the power and public utility industry evolve to solve the complex problems of a mass-produced and widely used good like electricity. Insull’s business contributions started a legacy of thought in American business politics, with ideas such as public vs. private companies, business regulation, unfettered capitalism, etc. Some may see him as a hero. Some may see him as a villain. Many likely see him as both. Despite the, at-times, fraught role he played in the business of energy production, there is little doubt that his innovations ultimately made electricity affordable and accessible to virtually everyone in America and fast-tracked America to become a leader in mass-produced/mass-consumed energy.

Corefficient’s Commitment to Innovation in Business

Like Thomas Insull, Corefficient has a mind for both energy innovation and business. We, too, keep pace with the technological innovations of the electrical industry. We, too, remain adaptable and grow with the demands of the energy industry. Our innovative business model is based on guaranteeing our customers a quality product through our quality services and building strategic partnerships with other companies that ensure our customers receive their product affordably and quickly.

Corefficient believes in meeting the modern needs of the energy consumer. We are committed to ensuring that our customers across the globe receive a quality product. We offer a variety of transformer core services, like core annealing, painting, and testing. Corefficient meets the challenges posed by traditional and new DOE transformer efficiency regulations and subsequent demands on transformer manufacturers to balance these new product requirements in a demanding market. Our proprietary transformer core design as well as our in-house services enable us to continually be a leading electrical transformer core manufacturer. We have a specific set of guidelines that ensure energy innovation and business efficiency: 1) our Corefficient-Complete Core Solution, and, 2) the Corefficient Guarantee.

Here is our Corefficient-Complete Core Solution:

- In-line sequential cutting ensures uniform stacking.

- Reduce core loss variability.

- Tighter tolerances on core parameters result in better performance.

- Fully tested core losses.

- Transformer designers do not have to allow loss tolerance in their calculation.

And here is our Corefficient Guarantee:

- We test all incoming material for quality first.

- We test & inspect core losses, dimensionality, weight, and sound pollution.

- We test wound cores before and after annealing.

- We adhere to DOE, ASTM, and NRCAN regulations.

- ISO-certified facility.

We live in a globalized world, and so this means developing strategic partnerships with other businesses. One of the many great advantages for our customers is our business to business (b2b) partnership with steel manufacturer, National Material de Mexico (NMM). Our electrical steel supplier is right down the road, which means faster turnaround and lower costs.

NMM, a subsidiary of National Material L.P., operates 16 steel service centers and processing facilities in North America. National Material L.P. specializes in supplying, servicing, and processing steel with unmatched efficiency and capacity due to the company’s substantial list of capabilities. It is both beneficial to Corefficient and to our companies to be partners with another forward-looking and dynamic business.

More About Corefficient

Corefficient is an energy-efficient transformer core company committed to adding value to their transformer core products combining experience and success in the fields of transformer core engineering, transformer core design, magnetic core expertise, cold-rolled steel, grain-oriented steel, electrical steel, and – most importantly – customer service.

Visit Corefficient’s website today: https://corefficientsrl.com/. Contact us through our website or via phone: North American Sales Engineer: 1 (704) 236-2510, Monterrey, México: (81) 2088-4000, or Toll Free USA: 1 (844) 202-1226.